CHESTER COUNTY, PA – HOW TO BUILD NET WORTH IN A HURRY THROUGH REAL ESTATE

CHESTER COUNTY, PA – YOU CAN BUILD NET WORTH IN A HURRY THROUGH REAL ESTATE AND PROTECT YOURSELF FROM INLATION AT THE SAME TIME.

If you would rather listen to the podcast of April 30 and May 1, just click on this hyperlink to listen to the 14 minute weekly program of “DAD AND DAUGHTER TALK REAL ESTATE”, https://bit.ly/Build_Wealth_Quick

If you’re following along with the news today, you’ve likely heard about rising inflation. You’re also likely feeling the impact in your day-to-day life as prices go up for gas, groceries, and more. These rising consumer costs can put a pinch on your wallet and make you re-evaluate any big purchases you have planned to ensure they’re still worthwhile.

If you’ve been thinking about purchasing a home this year, you’re probably wondering if you should continue down that path or if it makes more sense to wait. While the answer depends on your situation, here’s how homeownership can help you combat the rising costs that come with inflation.

Homeownership Offers Stability and Security

Investopedia explains that during a period of high inflation, prices rise across the board. That’s true for things like food, entertainment, and other goods and services, even housing. Both rental prices and home prices are on the rise. So, as a buyer, how can you protect yourself from increasing costs? The answer lies in homeownership.

Buying a home allows you to stabilize what’s typically your biggest monthly expense: your housing cost. If you get a fixed-rate mortgage on your home, you lock in your monthly payment for the duration of your loan, often 15 to 30 years. James Royal, Senior Wealth Management Reporter at Bankrate, says:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same.”

So even if other prices rise, your housing payment will be a reliable amount that can help keep your budget in check. If you rent, you don’t have that same benefit, and you won’t be protected from rising housing costs.

Use Home Price Appreciation to Your Benefit

While it’s true rising mortgage rates and home prices mean buying a house today costs more than it did a year ago, you still have an opportunity to set yourself up for a long-term win. Buying now lets you lock in at today’s rates and prices before both climb higher.

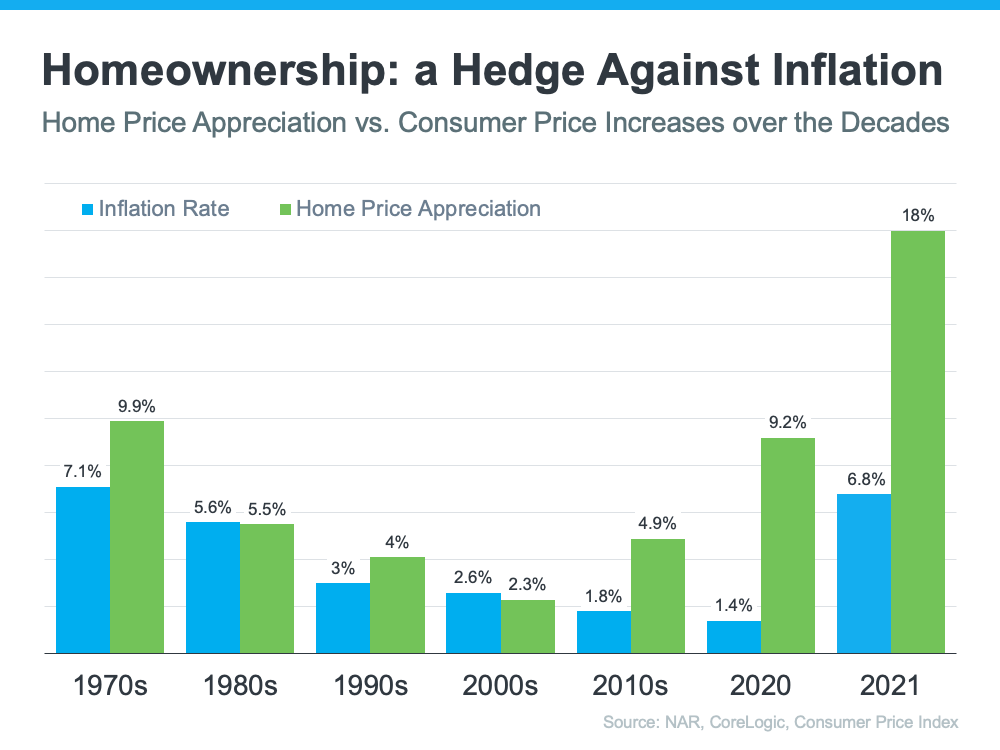

In inflationary times, it’s especially important to invest your money in an asset that traditionally holds or grows in value. The graph below shows how home price appreciation outperformed inflation in most decades going all the way back to the seventies – making homeownership a historically strong hedge against inflation (see graph below):

So, what does that mean for you?

So, what does that mean for you?

If you had bought the median priced house in 2012 for $329,900, by 2022 (right now) that median priced house would be selling for $510,000. That is a gain of $180,100 or a net gain or about $144,400 after deducting normal sales expenses and commissions.

Considering that it would cost you as little as $26,400 to get into that deal, That comes out to an annual rate of return of just above 18%.

If you bought the median priced house only five years ago for $380,000, your gain would be about $94,000; rate of return would be about 25% per year.

Today, experts say home prices will only go up from here thanks to the ongoing imbalance in supply and demand. Once you buy a house, any home price appreciation that does occur will be good for your equity and your net worth. And since homes are typically assets that grow in value (even in inflationary times), you have peace of mind that history shows your investment is a strong one.

Bottom Line

If you’re ready to buy a home, it probably makes a lot of sense to move forward with your plans especially in view of the rising inflation. If you want expert advice on your specific situation and how to time your purchase, let’s connect. Just call or text to 484-574-4088 or check out my web site, www.johnnherreid.com for ways to get in touch.

If you would rather listen to the podcast of April 30 and May 1, just click on this hyperlink to listen to the 14 minute weekly program of “DAD AND DAUGHTER TALK REAL ESTATE”, https://bit.ly/Build_Wealth_Quick