POWER OF HOME OWNERSHIP IN MEDIA, PA

Amidst the swirling uncertainties of 2023, whispers of an impending recession cast shadows over the real estate horizon. Speculations ran rife, with some media outlets ominously predicting a daunting 10-20% plummet in housing prices. Such forecasts might have left you grappling with doubt about stepping into the real estate market.

But reality painted a different picture: home prices surged, defying expectations. Brian D. Luke, the Head of Commodities at S&P Dow Jones Indices, sheds light on the unexpected turn of events:

“Reflecting on the past year, 2023 has surpassed the average annual home price gains observed over the last 35 years.”

Check out this chart of projected value growth in you buy the median priced home right now in the Media, PA area.

| WEALTH INCREASE, HOME OWNERSHIP, MEDIA, PA AREA | |||

| Initial Investment | $27,000 | ||

| Purchse Price | $320,000 | ||

| Annual Appreciation % | 3.5% | ||

| End of Year | Estimated Value | Cum Gain | Cum Gain/ initial Inv. |

| 1 | $331,200 | $11,200 | 41% |

| 2 | $342,792 | $22,792 | 84% |

| 3 | $354,790 | $34,790 | 129% |

| 4 | $367,207 | $47,207 | 175% |

| 5 | $380,060 | $60,060 | 222% |

| 6 | $393,362 | $73,362 | 272% |

| 7 | $407,129 | $87,129 | 323% |

| 8 | $421,379 | $101,379 | 375% |

| 9 | $436,127 | $116,127 | 430% |

| 10 | $451,392 | $131,392 | 487% |

| 11 | $467,190 | $147,190 | 545% |

| 12 | $483,542 | $163,542 | 606% |

| 13 | $500,466 | $180,466 | 668% |

| 14 | $517,982 | $197,982 | 733% |

| 15 | $536,112 | $216,112 | 800% |

| 16 | $554,876 | $234,876 | 870% |

| 17 | $574,296 | $254,296 | 942% |

| 18 | $594,397 | $274,397 | 1016% |

| 19 | $615,200 | $295,200 | 1093% |

| 20 | $636,732 | $316,732 | 1173% |

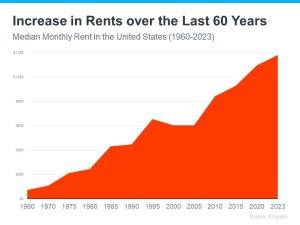

The resounding message? Home prices exhibit a consistent upward trajectory.

As Forbes succinctly articulates:

“. . . the U.S. real estate market boasts a longstanding and dependable track record of appreciating in value over time.”

Indeed, since 1980, the sole instance of a decline in home prices occurred during the housing market crash, vividly highlighted in red on the graph. Fortunately, today’s market bears little resemblance to the tumult of 2008. Scarce housing inventory struggles to meet burgeoning buyer demand, while homeowners enjoy substantial equity, fortifying their financial positions. Thus, the specter of a foreclosure wave, capable of precipitating price drops, remains remote.

For more evidence that home ownership is a powerful wealth producing tool, consider the below graph of median home sale prices in he Media, PA area for the last 10 years.

In the last 10 years, median sales price has gone from $408,000 to 629,250, an increase of $221,250 on an initial investment of about $53,000 or 417%

The near-universal uptrend in home values, barring the isolated downturns underscores the wisdom of homeownership as a potent investment strategy. By owning a home, you possess an asset primed for appreciation, steadily bolstering your net worth over time.

Therefore, if you find yourself on solid financial ground, equipped to navigate the responsibilities and expenses entailed in homeownership, seizing the opportunity to buy a home could prove astute.

If finding the estimated 13% of the purchase price is a challenge for you, it could well be a positive move for you to find a “fixer upper”. That is the subject of another article, but that can increase your returns even more.

In summary, The trajectory of home prices typically trends upward, solidifying homeownership as a savvy financial move, provided you’re prepared. Let’s collaborate to explore your objectives and the available options in Media, PA’s dynamic real estate landscape.

Call or text to 484 574 4088 to set up a time for us to chat about how to get you on this proven road to individual and family wealth.