Why Today’s Housing Market Isn’t Headed for a Crash

CONCLUSIONS

- 67% of Americans say a housing market crash is imminent in the next three years. With all the talk in the media lately about shifts in the housing market, it makes sense why so many people feel this way.

- But I disagree. Current data shows today’s market is nothing like it was before the housing crash in 2008.

- Especially with regards to mortgage lending standards

Back Then, Mortgage Standards Were Less Strict

During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. Fannie Mae the Government Sponsored Entity (and to a lesser degree, Freddy Mac) created artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance an existing one. Shocking to realize that this was done at the direction of our federal government in a misguided attempt to increase home ownership

As a result, much greater risk was not only tolerated but encouraged, in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. Today, things are different, and purchasers face much higher standards from Fannie and Freddy.

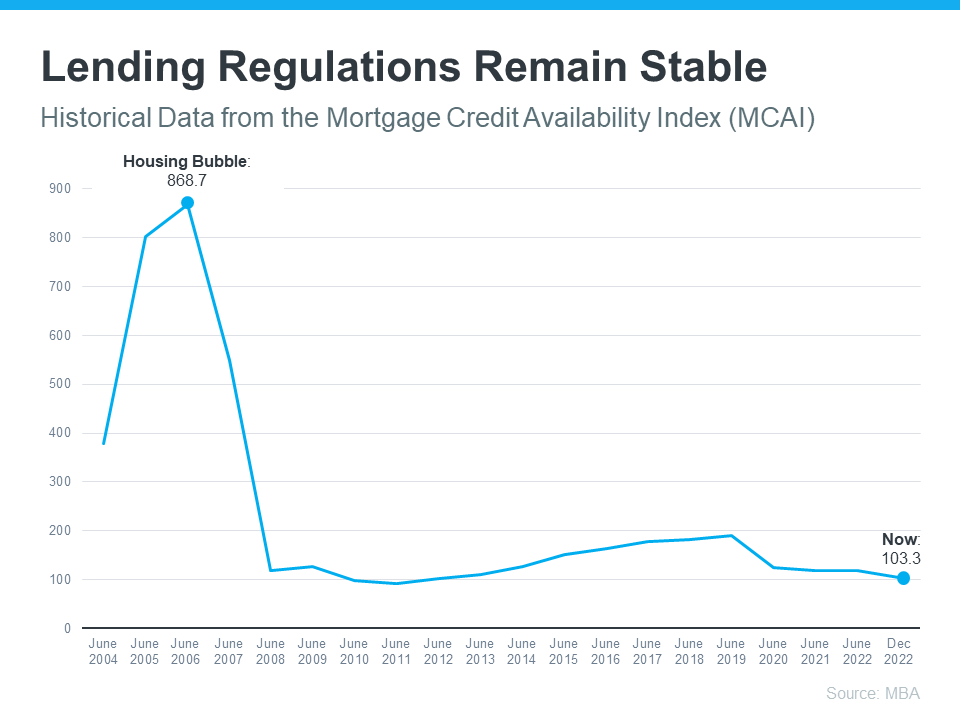

The graph below uses data from the Mortgage Bankers Association (MBA) to help tell this story. In this index, the higher the number, the easier it is to get a mortgage. The lower the number, the harder it is.

This graph also shows just how different things are today compared to the spike in credit availability leading up to the crash. Tighter lending standards have helped prevent a situation that could lead to a wave of foreclosures like the last time.

Foreclosure Volume Has Declined a Lot Since the Crash

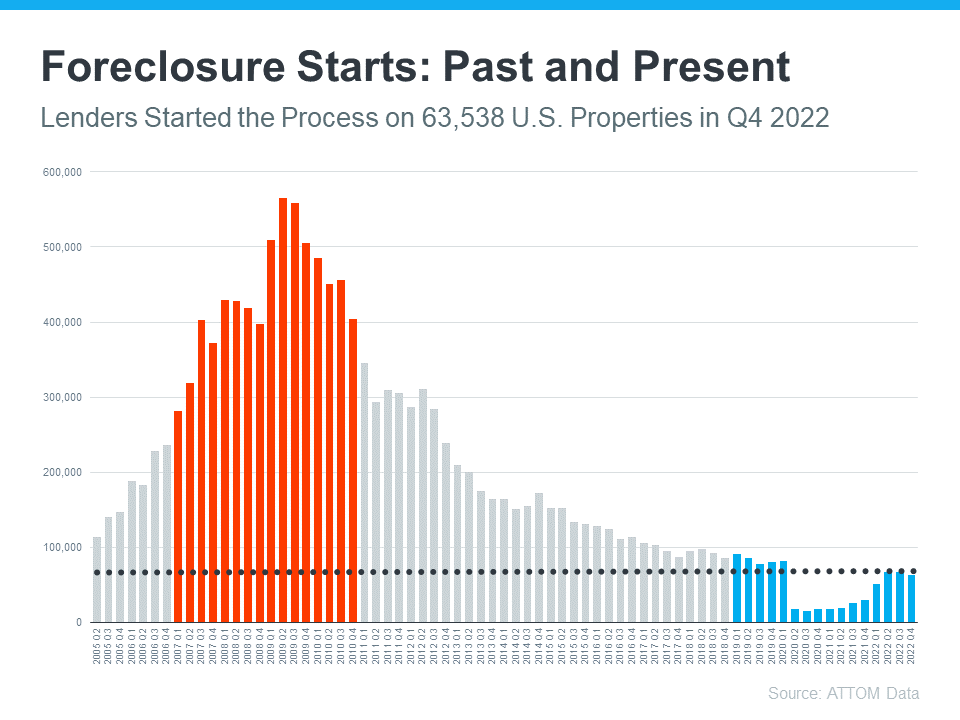

Another difference is the number of homeowners that were facing foreclosure when the housing bubble burst. Foreclosure activity has been lower since the crash, largely because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM to show the difference between last time and now:

So even as foreclosures tick up, the total number is still very low. And on top of that, most experts don’t expect foreclosures to go up drastically like they did following the crash in 2008. Bill McBride, Founder of Calculated Risk, explains the impact a large increase in foreclosures had on home prices back then – and how that’s unlikely this time.

“The bottom line is there will be an increase in foreclosures over the next year (from record level lows), but there will not be a huge wave of distressed sales as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.”

The Supply of Homes for Sale Today Is More Limited

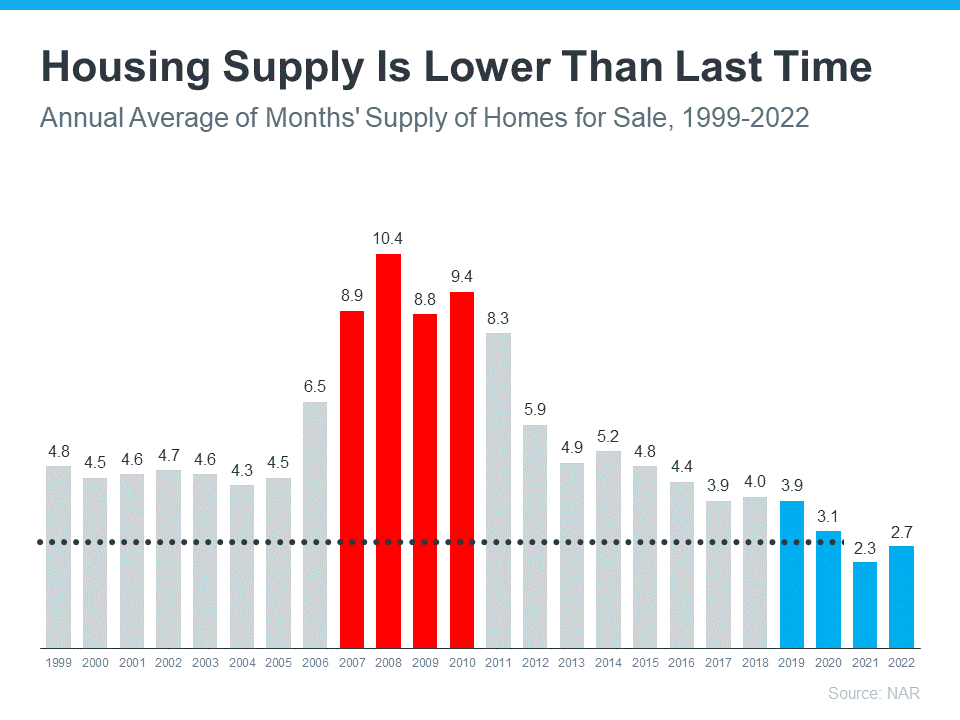

For historical context, there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Supply has increased since the start of this year, but there’s still a shortage of inventory available overall, primarily due to years of underbuilding homes.

The graph below uses data from the National Association of Realtors (NAR) to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just 2.7-months’ supply at the current sales pace, which is significantly lower than the last time. There just isn’t enough inventory on the market for home prices to come crashing down like they did last time, even though some overheated markets may experience slight declines.

Bottom Line

As shown above, housing supply increased dramatically during the 2006 through 2011. That was because investors thought the golden goose would continue laying eggs indefinitely and they kept building more and more houses on speculation. That all came crashing down in 2008 and almost bankrupted the country.

If recent headlines have you worried we’re headed for another housing crash, the data above should help ease those fears. Expert insights and the most current data clearly show that today’s market is nothing like it was last time.

RECOMMENDATIONS FOR YOU

- It’s also important to remember that every local market is different. That’s why it’s essential to lean on an expert for the latest information on the market in your area if you’re planning to make a move this spring.

- To get a quick update of what is new in real estate, click here to check out our new videos.

- Interested in what recent clients think of my service? Click here to read what they say.

- Interested to know what your house is worth? Click here to get the most extensive and accurate estimate of home value that is available on the Internet. No cost or obligation of course.

- No doubt, the housing market is shifting, and it can be a confusing place right now. I suggest that we connect so that I can help you make confident and informed decisions about what’s happening. Minimize the fear or uncertainty that could change your plans. If you’re unsure about how to make sense of what’s going on in today’s housing market, text or call me at 484-574-4088 or go to my web site, (johnherreid.com) and lets set up a time to meet, either on line or in person. I have the software so that we can meet virtually and make the best use of your time.

- If you’re looking to make that move up buy this year, I believe now is a good time to do it. The best way to ensure you’re up to date on the latest market insights is to partner with a trusted real estate advisor. Let’s connect. I would like to interview for the job of becoming your trusted real estate advisor.

- One of the biggest benefits of owning a home, regardless of your income level, is that it provides financial stability and an avenue to build wealth. Let’s connect to find out how much equity you have in your current home and how you can use it to fuel your next purchase.