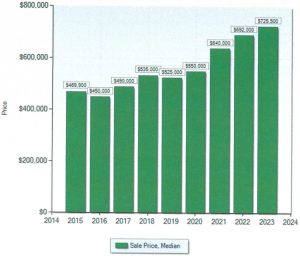

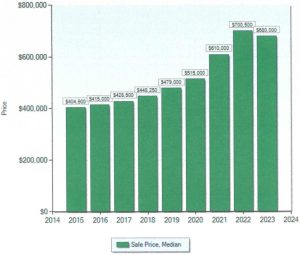

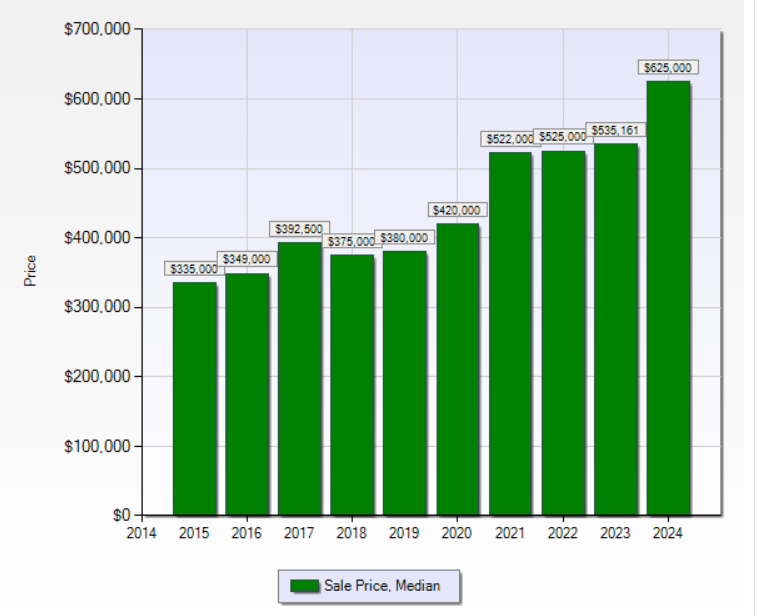

Wallingford home prices have steadily escalated for years. This demonstrates that this area is a solid long term choice for your family residence. Just check out the value increases since 2013:

If you would like to see what your Wallingford home is worth, just click on this hyperlink to find out. https://johnherreid.com/home-value/

Get the latest Marple Township Home Values from your local expert. Contact us for an accurate Home Value Report 484-574-4088

Get the latest Marple Township Home Values from your local expert. Contact us for an accurate Home Value Report 484-574-4088