Please watch the video first. It kind of sets up the whole article.

West Chester, PA Real Estate: Weathering Uncertainties with Optimism

The real estate market in West Chester, PA, is a focal point of discussion for buyers and sellers alike, especially with the looming concerns about a potential recession and its possible effects on the economy. This raises questions about the implications for the housing market in our picturesque Pennsylvania town.

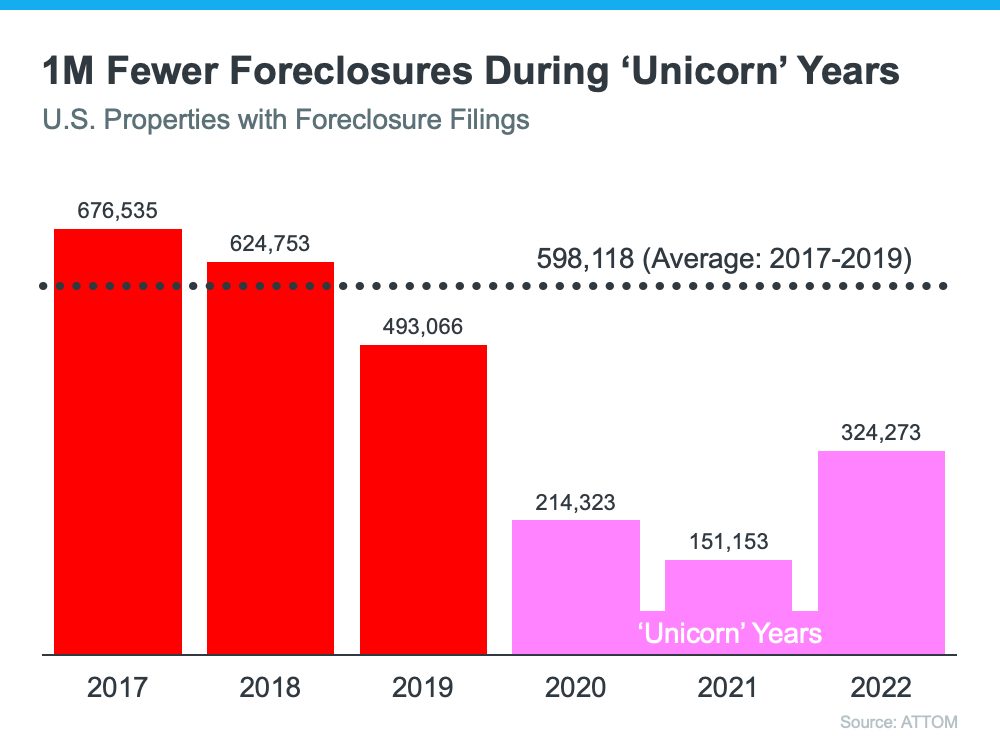

Recent talks have been dominated by the potential of a recession, sparking fears such as increased unemployment rates and the possibility of foreclosures like those witnessed 15 years ago. However, the sentiment is shifting towards optimism.

A key report from the Wall Street Journal’s Economic Forecasting Survey underscores this change in attitude. Now, less than half of the economists (48%) foresee a recession in the next year, a notable decrease from the 54% average in July. This is the first instance in over a year where the likelihood has fallen below 50%, indicating a more stable economic forecast for the West Chester area.

The concern regarding rising unemployment rates is pertinent to its impact on the housing market. Yet, current projections are reassuring. While some job losses might occur, they are not expected to be severe enough to trigger a widespread wave of foreclosures or significantly destabilize the housing market.

To understand this better, it’s useful to look at historical data from Macrotrends and the Bureau of Labor Statistics. The current unemployment rate is close to historic lows. For context, the average unemployment rate since 1948 is 5.7%, and it peaked at 8.3% during the 2008 crisis. Today’s figures are substantially lower than these historical benchmarks, indicating a stronger employment landscape.

Future projections suggest that the unemployment rate will likely stay below the 75-year average, a positive sign for the housing market in West Chester, PA. This implies a low risk of a housing market crash due to a surge in foreclosures.

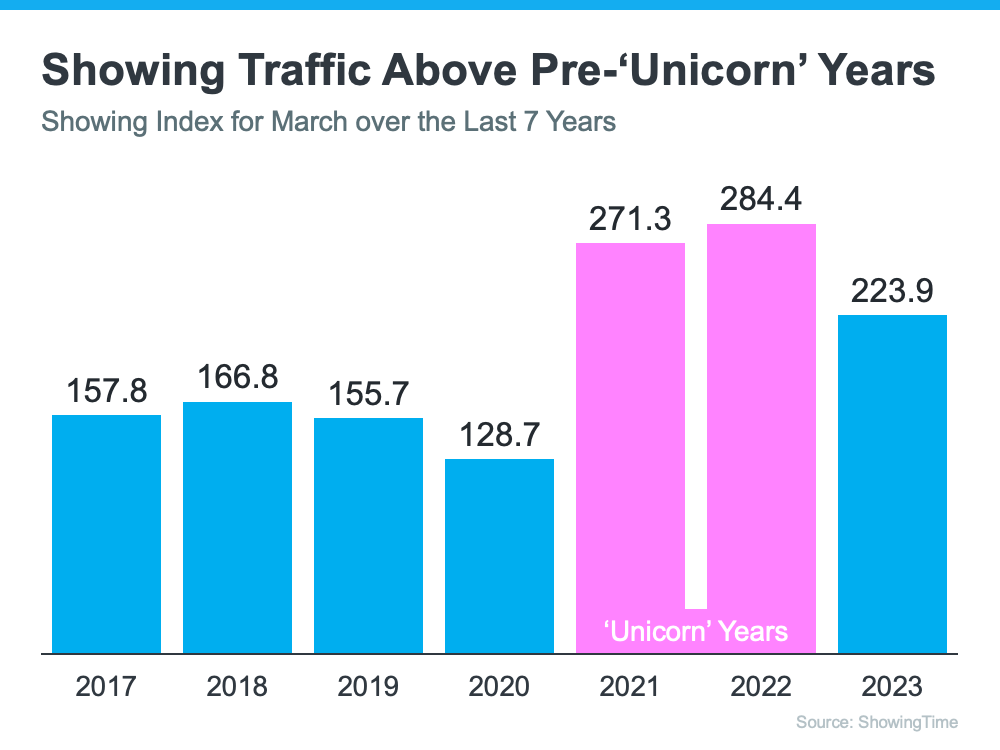

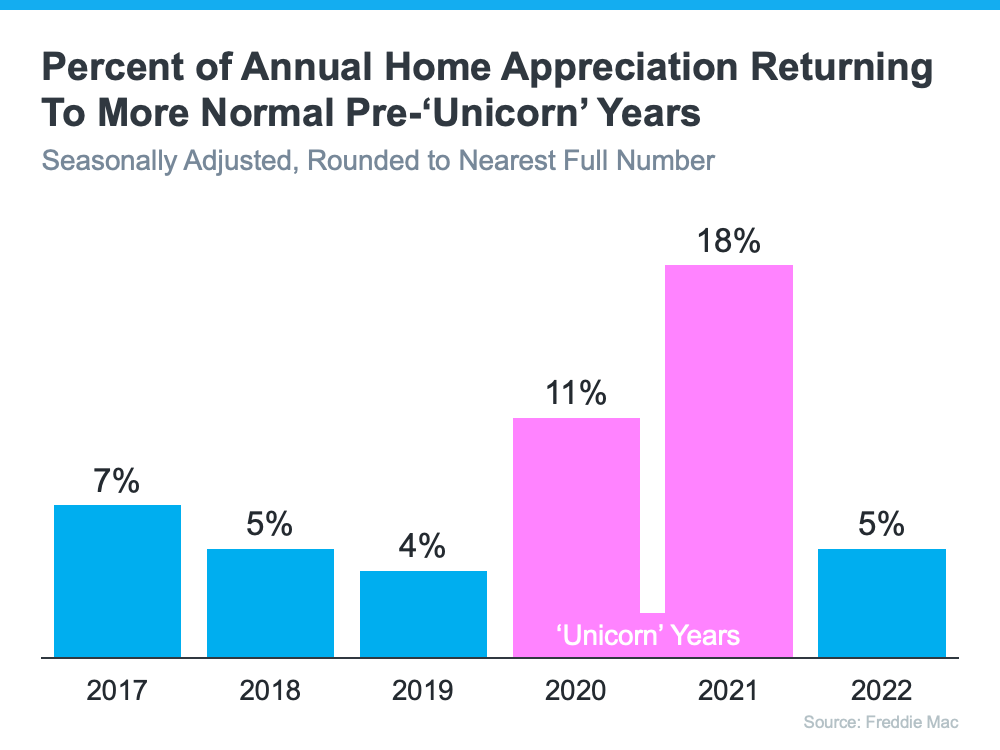

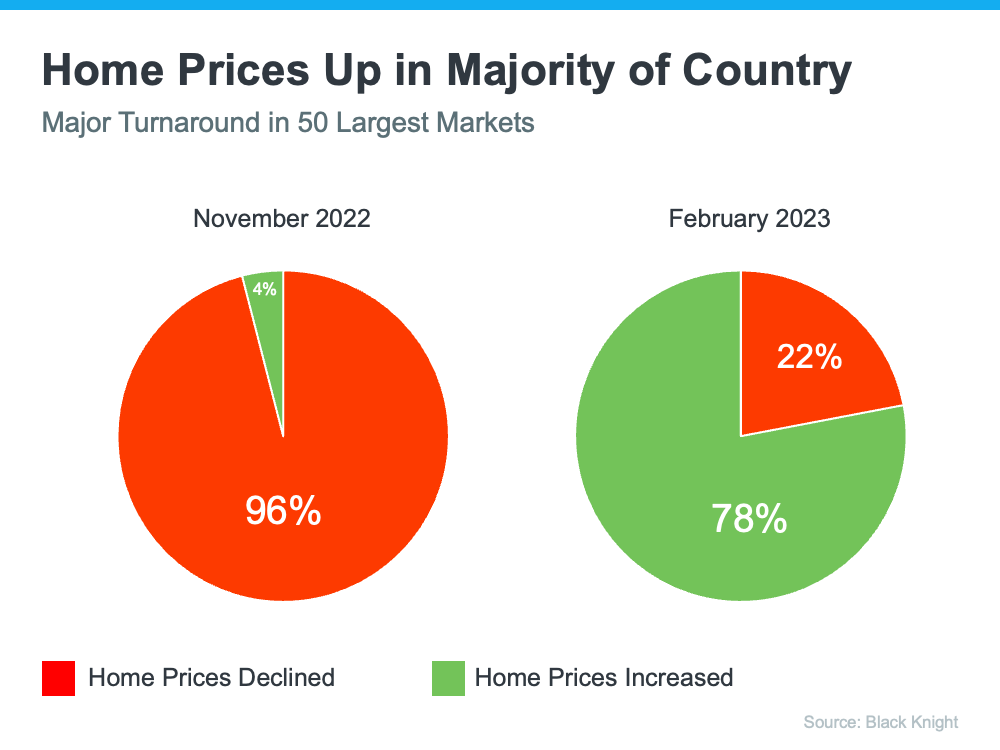

For sellers, the situation is favorable. Homes in West Chester are selling quickly, often within a week of listing, provided they are well-marketed and priced appropriately. Prices have risen by 13% in the past two years through November, and the trend is expected to continue due to the limited housing inventory, which currently stands at a 3-4 month supply.

For buyers, especially those upgrading their homes, finding the right property requires a skilled realtor, especially in this competitive market. I have a strategy just for move up buyers that works successfully and avoids the risk of not finding that house that you will love.

For first-time buyers, while higher mortgage rates may be a concern, there are innovative strategies to manage this challenge. With house prices predicted to keep rising in the coming years, now is an opportune time to enter the market.

In summary, the West Chester, PA real estate market stands resilient and strong, even amidst economic uncertainties. Most economists now discount the likelihood of an imminent recession and do not anticipate a significant rise in unemployment leading to a housing market downturn. For those concerned about unemployment and its effect on the West Chester housing market, it’s an excellent time to seek expert advice and explore local real estate opportunities.

here is what you need to do to make the right decision for you

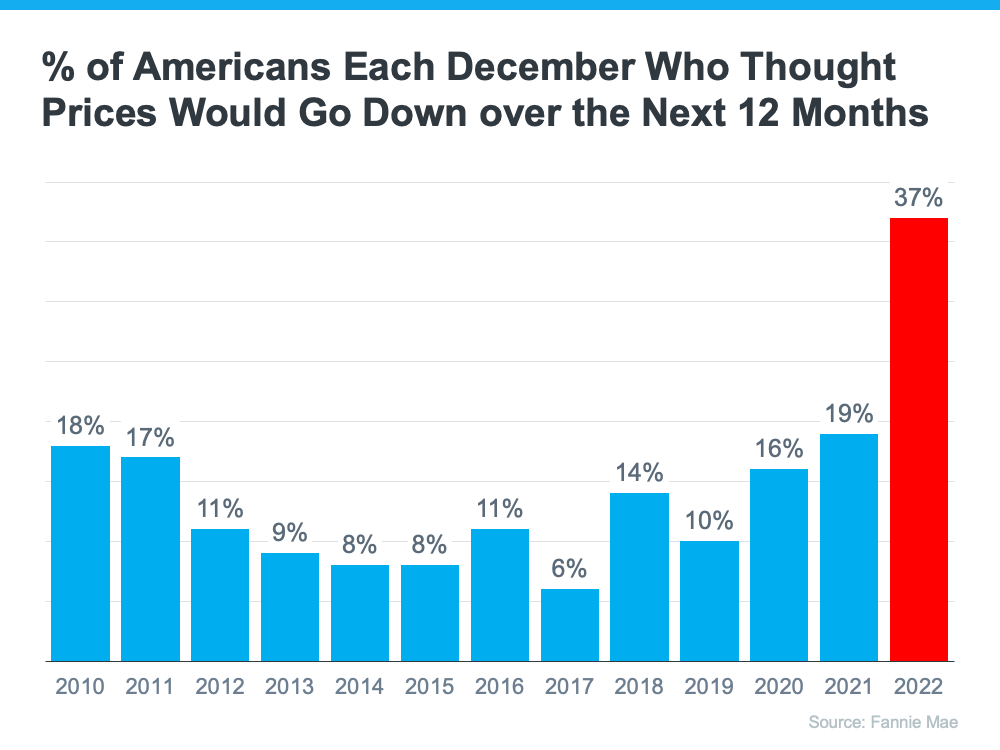

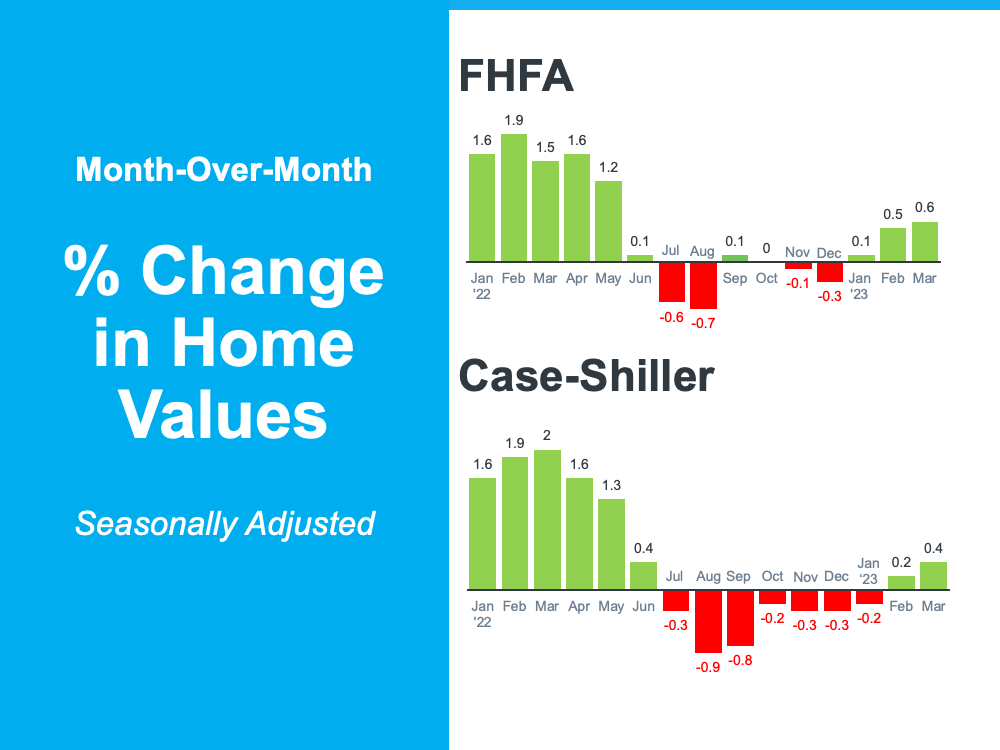

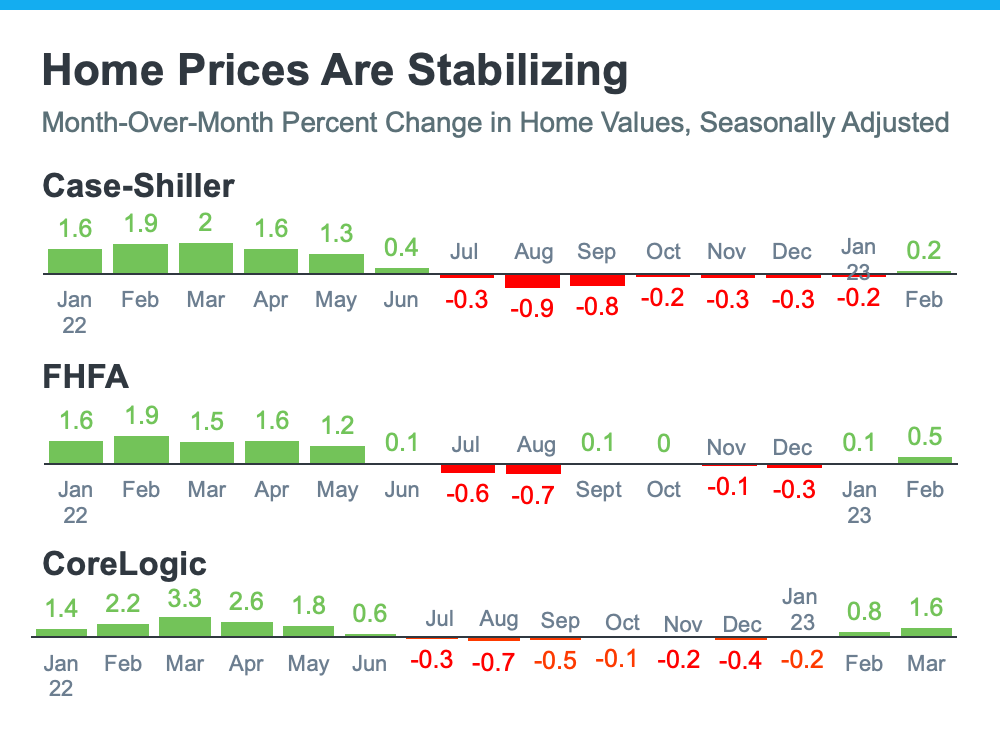

- Buyers: If you’ve been holding off on buying because you were worried the value of your home would go down, knowing home prices are stable and increasing is reasuring. It also gives you the opportunity to own something that usually becomes more valuable as time goes on.

- Sellers: If you’ve been waiting to sell your house because you were concerned about how changing home prices would affect its value, this should also reassure you. Even with the recent increase in mortgage rates, teaming with a real estate agent and getting your house on the market is the logical and smartest thing to do.

- It’s also important to remember that every local market is different. That’s why it’s essential to lean on an expert for the latest information on the market in your area if you’re planning to make a move. I would like to become that real estate expert upon whom you can lean.

- Let’s connect on the computer and have a virtual meeting. That is a great way to learn and see if I am the person you would like to do business with. Just call or text to 484-574-4088 or email to john@johnherreid.com

- Do I think that now is a good time to buy that first house or to sell and make that move up buy? Again, absolutely yes.

- To get a quick update of what is new in real estate, click here to check out our new videos.

- Interested in what recent clients think of my service? Click here to read what they say.

- Interested to know what your house is worth? Click here to get the most extensive and accurate estimate of home value that is available on the Internet. No cost or obligation of course.

- No doubt, the housing market is changing, and it can be a confusing place right now. I suggest that we connect so that I can help you make confident and informed decisions about what’s happening.

- If you’re looking to make that move up buy this year, I believe now is a good time to do it. The best way to ensure you’re up to date on the latest market insights is to partner with a trusted real estate advisor. Let’s connect. I would like to interview for the job of becoming your trusted real estate advisor. Again we can do that in person or on the computer.

- One of the biggest benefits of owning a home, regardless of your income level, is that it provides financial stability and an avenue to build wealth. By selling your house and leveraging your equity, it can be easier to pay for your next home. Let’s connect to find out how much equity you have in your current home and how you can use it to fuel your next purchase.

- There are clear opportunities for sellers right now. If you’re wondering if it’s the right time to make a move, let’s connect today.

- There are plenty of buyers out there right now trying to find a home that fits their needs. That’s because the job market is strong, and many people have the stable income needed to seriously consider homeownership. To put your house on the market and get in on the action, let’s connect on Zoom, in person or on the phone at 484 574 4088.