Media, PA Real Estate Market: Resilient in the Face of Uncertainty

In Media, PA, the real estate market is a hot topic for both buyers and sellers. Amidst widespread concerns about a potential recession and its effects on the economy, it’s natural to wonder how this might impact the housing market in our charming Pennsylvania town.

Recent discussions have centered around the possibility of a recession, and the fears that come with it, such as rising unemployment rates and the specter of foreclosures reminiscent of those seen 15 years ago. However, the narrative is changing, and there’s a growing sense of optimism.

A pivotal report from the Wall Street Journal’s Economic Forecasting Survey highlights this shift in perspective. Less than half of economists (48%) now predict a recession within the next year. This marks a significant drop from the 54% average in July and is the first time in over a year that the probability has dipped below 50%. This growing optimism among experts suggests a more stable economic outlook for the Media area.

The concern of rising unemployment rates naturally extends to its potential impact on the housing market. However, current projections offer a reassuring picture. Data indicates that while some job losses may occur, they are unlikely to reach a magnitude that would trigger a widespread wave of foreclosures or destabilize the housing market significantly.

It’s essential to understand this in the context of historical data from Macrotrends and the Bureau of Labor Statistics. The current unemployment rate is near historic lows. To put it in perspective, the average unemployment rate since 1948 is 5.7%, and during the 2008 financial crisis, it rose to 8.3%. Today’s figures are considerably lower than these benchmarks, suggesting a more robust employment landscape.

Looking ahead, projections indicate that the unemployment rate will likely remain below the 75-year average. This is an encouraging sign for the housing market in Media, PA, suggesting that the risks of a housing market crash caused by a wave of foreclosures are low.

What does this mean for sellers? Houses are selling rapidly in Media for prices that are making sellers happy.

- Only about a week on the market until there is an agreement of sale, if the house is well marketed and well priced. If you are thinking about selling, this is very good news.

- Prices continue to go up, 13% in the last two years, through November.

- Will this continue, yes I think it will because there are very few houses on the market. Only a 3-4 month inventory.

What does this mean for buyers?

- If you are a move up buyer, you will need a good realtor to make sure you can find the house you want to move into. I have a strategy that has worked well for move up buyers in this tight market. It will work for yiou and I would love to share it with you.

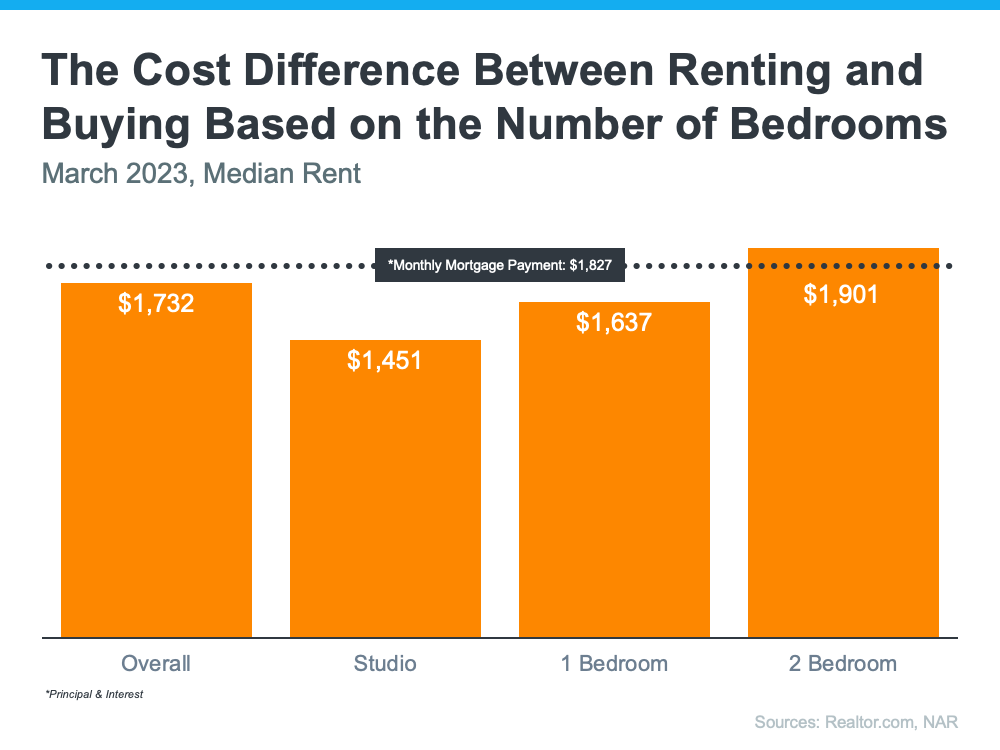

- If you are a first time buyer, the hgher mortgage rates have no doubt got you concerned. However there are inventive ways to manage this and again I would love to share them with you.

- House prices are forecast to continue to go up for the next several years so the best time to make that move is now.

In summary, the Media, PA real estate market remains strong and resilient, even in the face of economic uncertainties. Most economists no longer anticipate a recession in the near future, nor do they foresee a dramatic spike in unemployment leading to widespread foreclosures and a housing market collapse. For those with questions about unemployment and its impact on the housing market in Media, PA, it’s a great time to seek expert advice and explore the opportunities in our local real estate landscape.

here is what you need to do to make the right decision for you

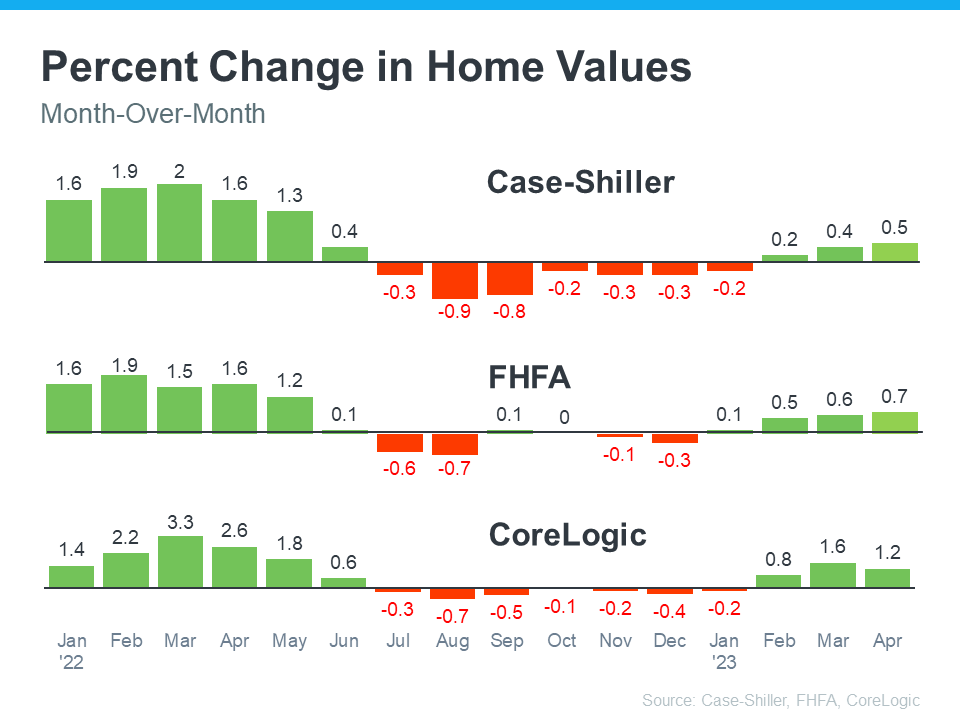

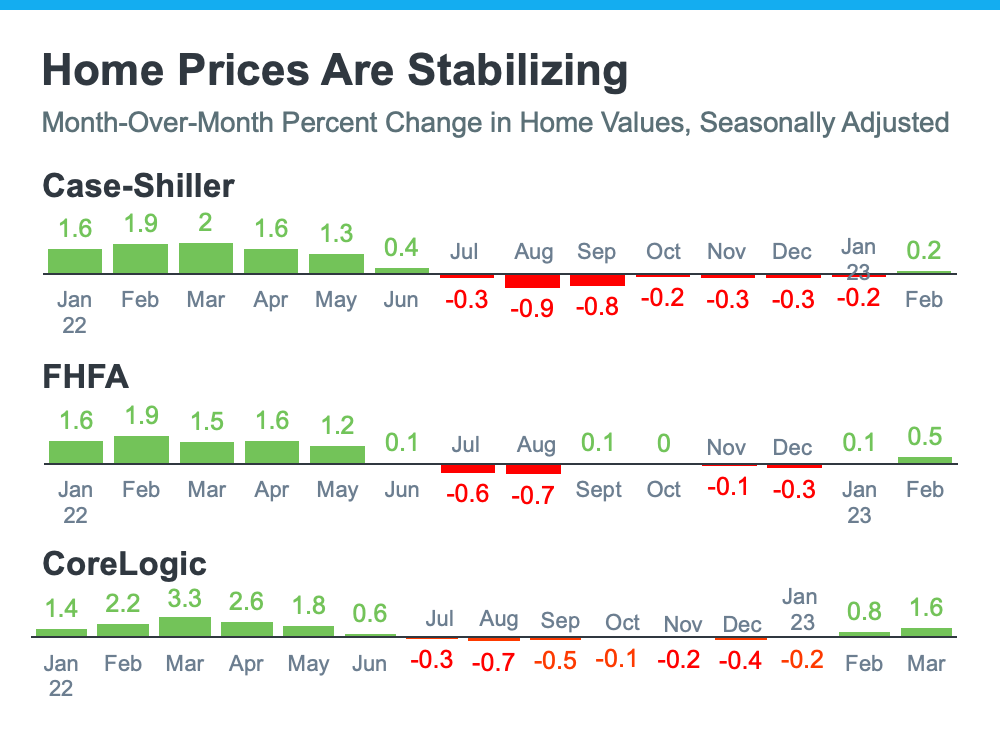

- Buyers: If you’ve been holding off on buying because you were worried the value of your home would go down, knowing home prices are stable and increasing is reasuring. It also gives you the opportunity to own something that usually becomes more valuable as time goes on.

- Sellers: If you’ve been waiting to sell your house because you were concerned about how changing home prices would affect its value, this should also reassure you. Even with the recent increase in mortgage rates, teaming with a real estate agent and getting your house on the market is the logical and smartest thing to do.

- It’s also important to remember that every local market is different. That’s why it’s essential to lean on an expert for the latest information on the market in your area if you’re planning to make a move. I would like to become that real estate expert upon whom you can lean.

- Let’s connect on the computer and have a virtual meeting. That is a great way to learn and see if I am the person you would like to do business with. Just call or text to 484-574-4088 or email to john@johnherreid.com

- Do I think that now is a good time to buy that first house or to sell and make that move up buy? Again, absolutely yes.

- To get a quick update of what is new in real estate, click here to check out our new videos.

- Interested in what recent clients think of my service? Click here to read what they say.

- Interested to know what your house is worth? Click here to get the most extensive and accurate estimate of home value that is available on the Internet. No cost or obligation of course.

- No doubt, the housing market is changing, and it can be a confusing place right now. I suggest that we connect so that I can help you make confident and informed decisions about what’s happening.

- If you’re looking to make that move up buy this year, I believe now is a good time to do it. The best way to ensure you’re up to date on the latest market insights is to partner with a trusted real estate advisor. Let’s connect. I would like to interview for the job of becoming your trusted real estate advisor. Again we can do that in person or on the computer.

- One of the biggest benefits of owning a home, regardless of your income level, is that it provides financial stability and an avenue to build wealth. By selling your house and leveraging your equity, it can be easier to pay for your next home. Let’s connect to find out how much equity you have in your current home and how you can use it to fuel your next purchase.

- There are clear opportunities for sellers right now. If you’re wondering if it’s the right time to make a move, let’s connect today.

- There are plenty of buyers out there right now trying to find a home that fits their needs. That’s because the job market is strong, and many people have the stable income needed to seriously consider homeownership. To put your house on the market and get in on the action, let’s connect on Zoom, in person or on the phone at 484 574 4088.