WEST CHESTER, PA – BUILD FAMILY WEALTH THROUGH HOME OWNERSHIP

Here are the main factors that make residential real estate the most important investment most people ever make. We will explore every one in this article

- Home values have been steadily increasing over the past 60 years, providing an opportunity for homeowners to build equity.

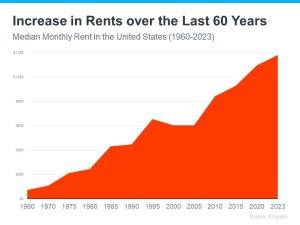

- Rent prices are consistently rising, making homeownership a more appealing option than renting.

- Home prices have seen dramatic increases and slight declines in the past year but are now appreciating at a more normal pace.

- Low inventory of homes on the market is leading to fewer choices for buyers and resulting in faster sales, multiple offers, and potentially higher sale prices for sellers.

HOME VALUES HAVE BEEN STEADILY INCREASING OVER THE PAST 60 YEARS

Homeownership is a powerful wealth-building tool, offering several significant financial advantages. Firstly, as a homeowner, you enjoy potential capital gains as your property value appreciates over time. This can significantly contribute to your net worth. Secondly, monthly mortgage payments often replace rent, and these payments can act as a form of forced savings as you gradually own more of your property. This contributes to building equity that can be leveraged in the future for financial needs. Lastly, homeownership comes with tax benefits, such as the potential to deduct mortgage interest and property tax payments. These factors combine to make homeownership a financially savvy move.

Check out this graph for the long term trend. The only downtrend was in the 2008-2013 time frame when the federal government mandated that sub prime mortgages be granted to people who had poor credit.

Over the long term, homeownership can prove to be a highly beneficial financial strategy. One advantage is the potential for substantial appreciation in property value, a trend that has been consistent throughout history. This not only contributes to overall wealth, but also offers opportunities for refinancing or drawing on home equity in times of need. Furthermore, the fixed-rate mortgage payments act as a hedge against inflation, keeping housing costs stable while rents may increase over time. Lastly, owning a home can also be a part of a well-rounded retirement plan. Once the mortgage is fully paid off, housing costs are significantly reduced, and the home can even be sold as a part of a downsizing strategy, potentially adding a significant sum to your retirement nest egg. In essence, homeownership can be a powerful tool for financial planning and long-term wealth generation.

For an actual example, consider the below chart which shows actual wealth buildup if a person bought a median priced house in West Chester in 2014 and held it until 2023.

| MEDIAN SALES PRICE, WEST CHESTER AREA, SINGLE FAMILY | ||||

| Primary Year | Sale Price, Median | Annual % Change | Cumulative % Change | Equity Buildup. |

| 2014 | $415,000 | |||

| 2015 | $417,500 | 0.6% | 0.6% | $2,500 |

| 2016 | $423,500 | 1.4% | 2.0% | $8,500 |

| 2017 | $441,000 | 4.1% | 6.3% | $26,000 |

| 2018 | $469,900 | 6.6% | 13.2% | $54,900 |

| 2019 | $480,000 | 2.1% | 15.7% | $65,000 |

| 2020 | $510,000 | 6.3% | 22.9% | $95,000 |

| 2021 | $580,000 | 13.7% | 39.8% | $165,000 |

| 2022 | $640,000 | 10.3% | 54.2% | $225,000 |

| 2023 | $693,000 | 8.3% | 67.0% | $278,000 |

| West Chester, Downingtown and Great Valley School Districts | ||||

| All Positive Years since 2014 | ||||

| Trend Expected to Continue | ||||

| Assume 10% Down in 2014, Mortgage Amount = | $373,500 | |||

| Interest Rate = 7% | ||||

| % of Principal Remaning After 9 Years | 88% | |||

| Amount Remaining After 9 Years | $329,147 | |||

| Principal Reduction | $44,353 | |||

| Total Equity (Net Worth) Increase | $322,353 | |||

As you can see, the wealth improvement of $322,353 in this example is composed of the value increase of the home ($278,000), plus the reduction in the remaining mortage balance ($44,353).

RENT PRICES ARE CONSISTENTLY RISING MAKING HOMEOWNERSHIP MORE APPEALING

In comparison to homeownership, renting offers its own unique set of benefits and drawbacks. From a financial perspective, renters often have lower monthly costs and aren’t responsible for maintenance or repair expenses, providing greater budget flexibility. Renting also offers more geographical mobility for those who aren’t locked into a long-term location due to career or lifestyle. On the downside, renters don’t accumulate equity and don’t enjoy the potential capital appreciation that homeowners do. They are also subject to annual rent increases and have less control over their living space.

Consider this graph of rent increases over time.

In contrast, homeownership provides a long-term investment and opportunity to build equity. However, it also involves higher upfront costs, ongoing maintenance responsibilities, and less flexibility to move. In essence, the decision between renting and homeownership largely depends on individual financial circumstances, lifestyle preferences, and long-term goals. But if you can swing it, owning your own home has humungous financial benefts (in this case $322,353) as opposed to renting which has a financial benefit of absolute ZERO!!!!!

And the basic question is this. To whose wealth do you want to contribute? Yours or your landlord ? I think know which one you should pick.

HOME PRICES HAVE SEEN DRAMATIC INCREASES AND SLIGHT DECLINES IN THE PAST YEAR, BUT ARE NOW APPRECIATING AT A MORE NORMAL PACE

The current surge in home prices is largely attributed to a dynamic interplay of supply and demand factors. On the supply side, there’s a noticeable shortage of homes available for sale. Furthermore, the demographic shift characterized by millennials entering their prime home-buying years has fueled demand. Additionally, the ongoing pandemic has underscored the value of homeownership, leading more people to aspire for their own space. These factors combined create a sellers’ market where the demand for houses outstrips supply, causing a surge in home prices.

LOW INVENTORY OF HOMES MEANS FEWER CHOICES FOR BUYERS AND HIGHER PRICES FOR SELLERS

In a low inventory market, selling your property can be a strategic move, especially if you’re considering moving to a higher-priced home. Firstly, you’re likely to sell your current home at a competitive price due to high demand and low supply. Consider the below graph which shows supply of homes for sale.

Secondly, while prices for higher-end homes may also be inflated, typically, the rate of price appreciation is slower for more expensive homes. This disparity in price growth rates between lower and higher-priced properties means that the ‘price gap’ between your current home and your next, more expensive home could be narrowing. Thus, upgrading to a more expensive home in a low inventory, high demand market might not be as financially demanding as it would be in a balanced market.

here is what you need to do to make the right decision for you

- Buyers: If you’ve been holding off on buying because you were worried the value of your home would go down, knowing home prices are stable and increasing is reasuring. It also gives you the opportunity to own something that usually becomes more valuable as time goes on.

- Sellers: If you’ve been waiting to sell your house because you were concerned about how changing home prices would affect its value, this should also reassure you. Even with the recent increase in mortgage rates, teaming with a real estate agent and getting your house on the market is the logical and smartest thing to do.

- It’s also important to remember that every local market is different. That’s why it’s essential to lean on an expert for the latest information on the market in your area if you’re planning to make a move. I would like to become that real estate expert upon whom you can lean.

- Let’s connect on the computer and have a virtual meeting. That is a great way to learn and see if I am the person you would like to do business with. Just call or text to 484-574-4088 or email to john@johnherreid.com

- Do I think that now is a good time to buy that first house or to sell and make that move up buy? Again, absolutely yes.

- To get a quick update of what is new in real estate, click here to check out our new videos.

- Interested in what recent clients think of my service? Click here to read what they say.

- Interested to know what your house is worth? Click here to get the most extensive and accurate estimate of home value that is available on the Internet. No cost or obligation of course.

- No doubt, the housing market is changing, and it can be a confusing place right now. I suggest that we connect so that I can help you make confident and informed decisions about what’s happening.

- If you’re looking to make that move up buy this year, I believe now is a good time to do it. The best way to ensure you’re up to date on the latest market insights is to partner with a trusted real estate advisor. Let’s connect. I would like to interview for the job of becoming your trusted real estate advisor. Again we can do that in person or on the computer.

- One of the biggest benefits of owning a home, regardless of your income level, is that it provides financial stability and an avenue to build wealth. By selling your house and leveraging your equity, it can be easier to pay for your next home. Let’s connect to find out how much equity you have in your current home and how you can use it to fuel your next purchase.

- There are clear opportunities for sellers right now. If you’re wondering if it’s the right time to make a move, let’s connect today.

- There are plenty of buyers out there right now trying to find a home that fits their needs. That’s because the job market is strong, and many people have the stable income needed to seriously consider homeownership. To put your house on the market and get in on the action, let’s connect on Zoom, in person or on the phone at 484 574 4088.