WEALTHY IN WEST CHESTER, PA; OWNING YOUR HOME MAKES ALL THE DIFFERENCE

If you’re a resident of the charming town of West Chester, PA, you’re probably aware of the unique blend of historic beauty and modern convenience that makes this place so special. Nestled in the heart of Chester County, West Chester is not just a great place to live but also a smart place to invest in homeownership. In this article, we’ll explore how owning your home in West Chester is the key strategy for most people for building wealth in our community.

Why West Chester, PA is a Wealth-Building Haven

West Chester, PA, is more than just a picturesque town; it’s a community that offers a wealth of opportunities for those who choose to call it home. Here are some compelling reasons why owning a piece of West Chester real estate can set you on the path to financial success:

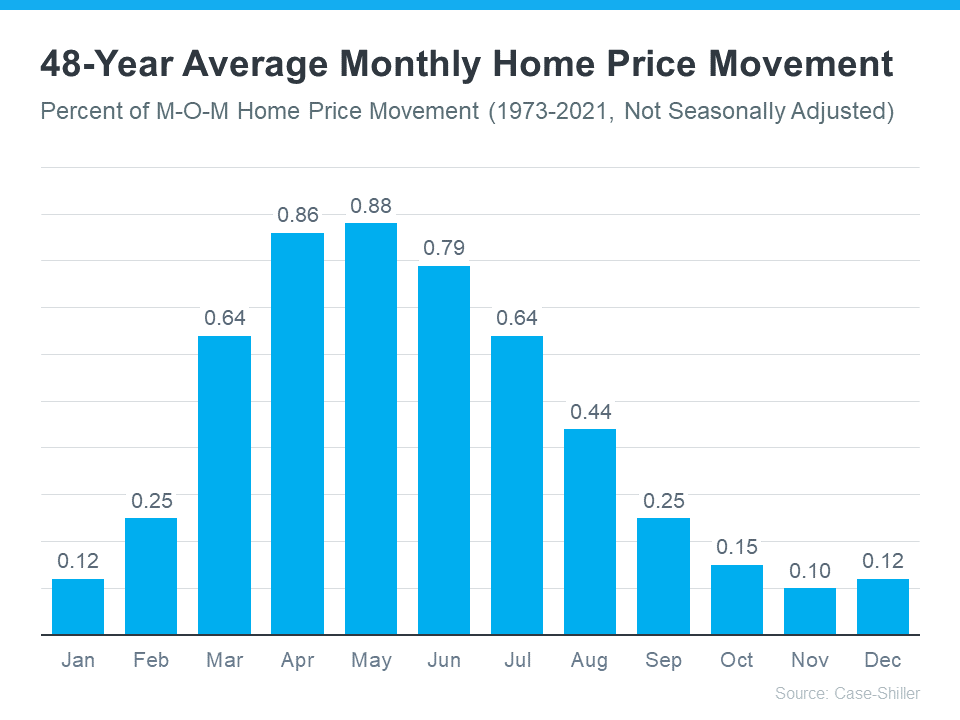

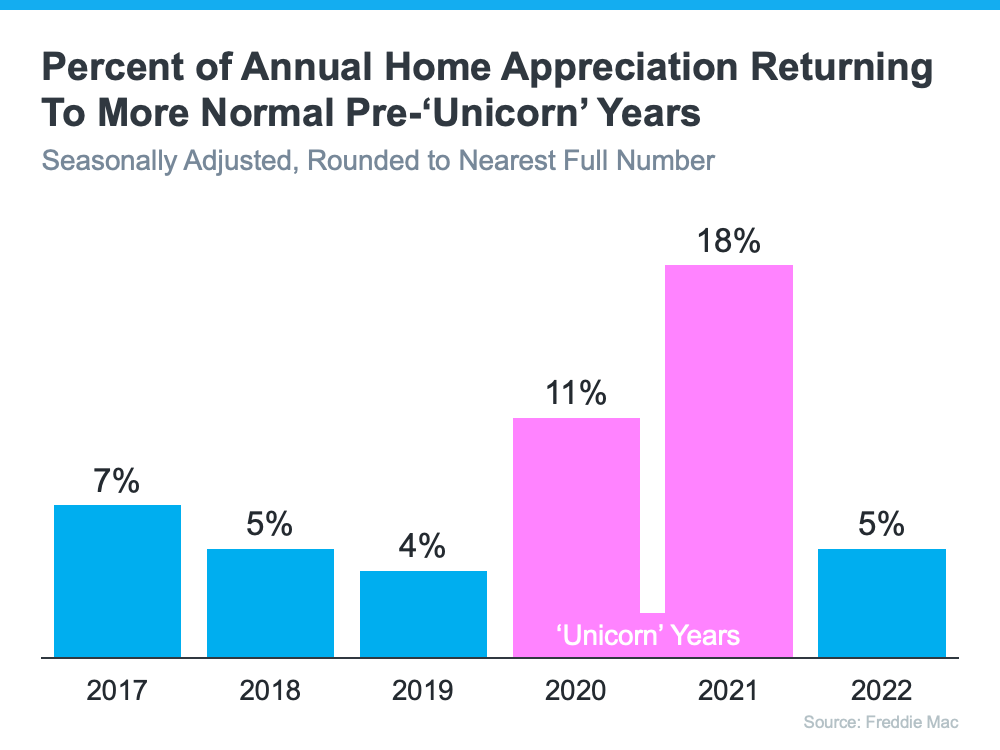

Steady Property Appreciation: West Chester’s real estate market has shown consistent growth over the years. Owning a home here means you’re likely to see your property’s value appreciate steadily over time, providing you with a solid return on your investment. For example, please check out this chart to show how your wealth would have built up in you bought the median priced home just five years ago.

| CHESTER COUNTY, ESTIMATED EQUITY GROWTH, LAST FIVE YEARS | |||||||

| Purchase | Sale Price | Down Payment | Estimated Total | Price Growth | Estimated | Total Equity | Equity, % |

| Year | Median | at 3.5% | Closing Costs | Equity to 12/22 | Pay Down | of Sale Price | |

| 2017 | $380,000 | $13,300 | $30,400 | $160,000 | $63,333 | $236,633 | 62% |

| 2018 | $399,000 | $13,965 | $31,920 | $141,000 | $53,200 | $208,165 | 52% |

| 2019 | $405,000 | $14,175 | $32,400 | $135,000 | $40,500 | $189,675 | 47% |

| 2020 | $440,000 | $15,400 | $35,200 | $100,000 | $29,333 | $144,733 | 33% |

| 2021 | $499,000 | $17,465 | $39,920 | $41,000 | $16,633 | $75,098 | 15% |

| 2022 | $540,000 | $18,900 | $43,200 | $0 | $0 | $18,900 | 4% |

Take a look at the top row, in bold blue italics. If you bought the median priced house in 2017 for $380,000 and a minimum down payment of 3.5%, your total closing costs would have been about $30,400. After 5 years, that same median priced house is priced at $540,000. That means your equity just due to the value increase is $160,000. You have also been paying your mortgage down for 5 years resulting in a balance reduction of $63,333. Your total equity then comes to $236,633 or 62% of the initial cost of the house. Your investment of $30,400 grew to $236,633 which is a 778% gain.

That is why real estate has been ranked as the #1 investment opportunity in the United States for several years running.

Local Economy: West Chester boasts a strong local economy with diverse industries, including education (West Chester University), healthcare, and technology. With numerous employment opportunities in the area, you’ll have the financial stability needed to build wealth through homeownership.

Historic Charm and Community Spirit: West Chester is known for its vibrant community and historic charm. This attracts not only residents but also tourists.

Educational Opportunities: The presence of West Chester University adds to the town’s allure. Whether you’re looking to further your education or invest in properties for student housing, the university’s presence can be a significant advantage.

Higher Interest Rates: True, interest rates have risen dramatically from about 3% to as high as 8%. However, even with this headwind, home prices are predicted to keep on rising so it’s still an opportune time to buy a home in West Chester. Your payments will be higher but you still start building equity right away.

Tax Benefits: As a homeowner in West Chester, you can benefit from various tax incentives and deductions, which can help you save money and grow your wealth over time.

Community Involvement: Being part of the West Chester community means you have the opportunity to engage in local events and initiatives, which can enhance your sense of belonging and connection to your neighborhood.

Steps to Owning Your Home in West Chester

Now that you understand the potential wealth-building benefits of owning a home in West Chester, it’s time to take action. Here are some steps to help you get started on your homeownership journey:

Financial Preparation: Assess your financial situation and create a budget to determine how much you can comfortably afford for your new home. Consider saving for a down payment, as a larger down payment can lead to lower monthly mortgage payments.

Research Local Real Estate: Work with a local real estate agent who knows the West Chester market inside and out. They can help you find the right neighborhood and property that fits your budget and goals.

Mortgage Pre-Approval: Get pre-approved for a mortgage to show sellers that you’re a serious buyer. This can give you a competitive edge in a hot market.

Home Inspection: Once you find a property you love, work with your realtor to decide if you need to inspect the house or if competitive conditions dictate that you should make your offer with no inspection.

Closing the Deal: Work closely with your real estate agent and lender to complete the necessary paperwork and finalize your purchase.

By following these steps and embracing the wealth-building opportunities that West Chester, PA, has to offer, you can secure your financial future while enjoying all the benefits of living in this wonderful community. Owning your home in West Chester isn’t just about having a place to live—it’s about investing in your future and building wealth right here in our beautiful town. Don’t miss out on the opportunity to make West Chester, PA, your home and your key to financial success.

here is what you need to do to make the right decision for you

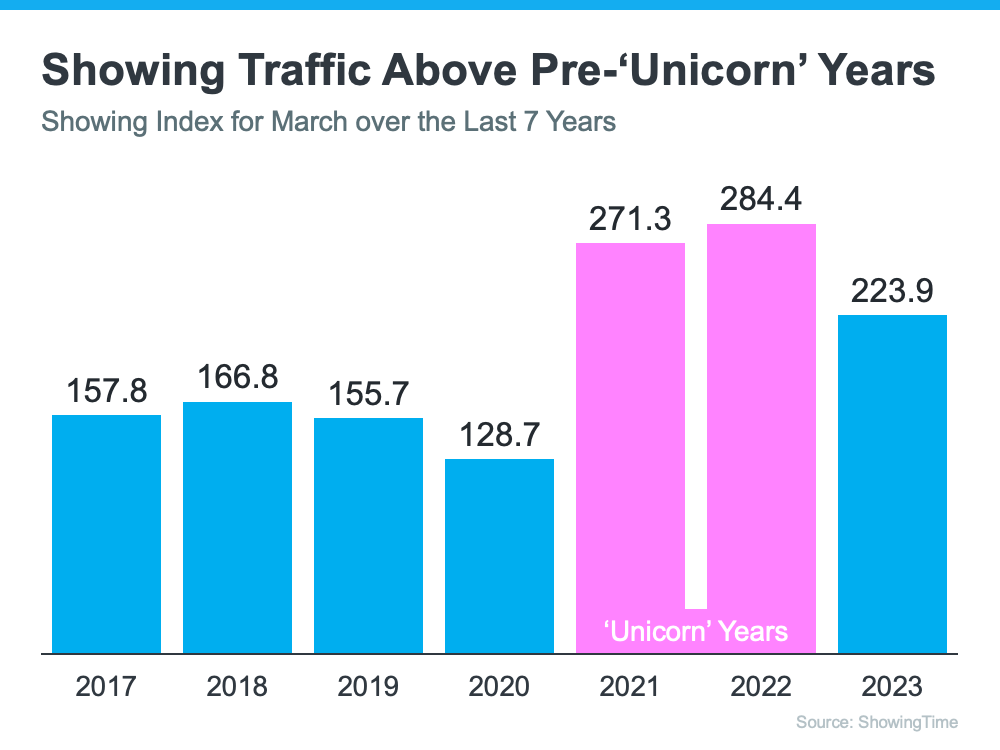

- Buyers: If you’ve been holding off on buying because you were worried the value of your home would go down, knowing home prices are stable and increasing is reasuring. It also gives you the opportunity to own something that usually becomes more valuable as time goes on.

- Sellers: If you’ve been waiting to sell your house because you were concerned about how changing home prices would affect its value, this should also reassure you. Even with the recent increase in mortgage rates, teaming with a real estate agent and getting your house on the market is the logical and smartest thing to do.

- It’s also important to remember that every local market is different. That’s why it’s essential to lean on an expert for the latest information on the market in your area if you’re planning to make a move. I would like to become that real estate expert upon whom you can lean.

- Let’s connect on the computer and have a virtual meeting. That is a great way to learn and see if I am the person you would like to do business with. Just call or text to 484-574-4088 or email to john@johnherreid.com

- Do I think that now is a good time to buy that first house or to sell and make that move up buy? Again, absolutely yes.

- To get a quick update of what is new in real estate, click here to check out our new videos.

- Interested in what recent clients think of my service? Click here to read what they say.

- Interested to know what your house is worth? Click here to get the most extensive and accurate estimate of home value that is available on the Internet. No cost or obligation of course.

- No doubt, the housing market is changing, and it can be a confusing place right now. I suggest that we connect so that I can help you make confident and informed decisions about what’s happening.

- If you’re looking to make that move up buy this year, I believe now is a good time to do it. The best way to ensure you’re up to date on the latest market insights is to partner with a trusted real estate advisor. Let’s connect. I would like to interview for the job of becoming your trusted real estate advisor. Again we can do that in person or on the computer.

- One of the biggest benefits of owning a home, regardless of your income level, is that it provides financial stability and an avenue to build wealth. By selling your house and leveraging your equity, it can be easier to pay for your next home. Let’s connect to find out how much equity you have in your current home and how you can use it to fuel your next purchase.

- There are clear opportunities for sellers right now. If you’re wondering if it’s the right time to make a move, let’s connect today.

- There are plenty of buyers out there right now trying to find a home that fits their needs. That’s because the job market is strong, and many people have the stable income needed to seriously consider homeownership. To put your house on the market and get in on the action, let’s connect on Zoom, in person or on the phone at 484 574 4088.