DELAWARE COUNTY, ARE HOME PRICES GOING TO CRASH?

The short answer is NO!!!!! And here are the reasons and he recent history to back up that statement

There have been a lot of shifts in the housing market recently. Mortgage rates rose dramatically last year, impacting many people’s ability to buy a home. And after several years of rapid price appreciation, national home prices finally peaked last summer. These changes led to a rise in headlines saying prices would end up crashing.

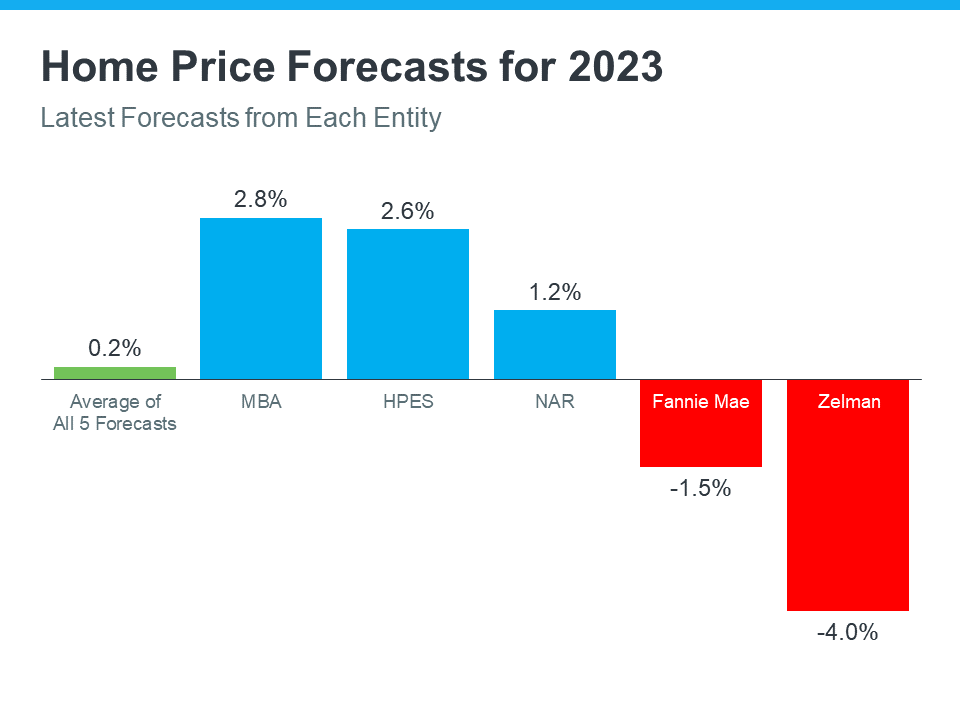

Even though we’re no longer seeing the buyer frenzy that drove home values up during the pandemic, prices have been relatively flat at the national level. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), doesn’t expect that to change:

“[H]ome prices will be steady in most parts of the country with a minor change in the national median home price.”

You might think sellers would have to lower prices to attract buyers in today’s market, and that’s part of why some may have been waiting for prices to come crashing down. But there’s another factor at play – low inventory. And according to Yun, that’s limiting just how low prices will go:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

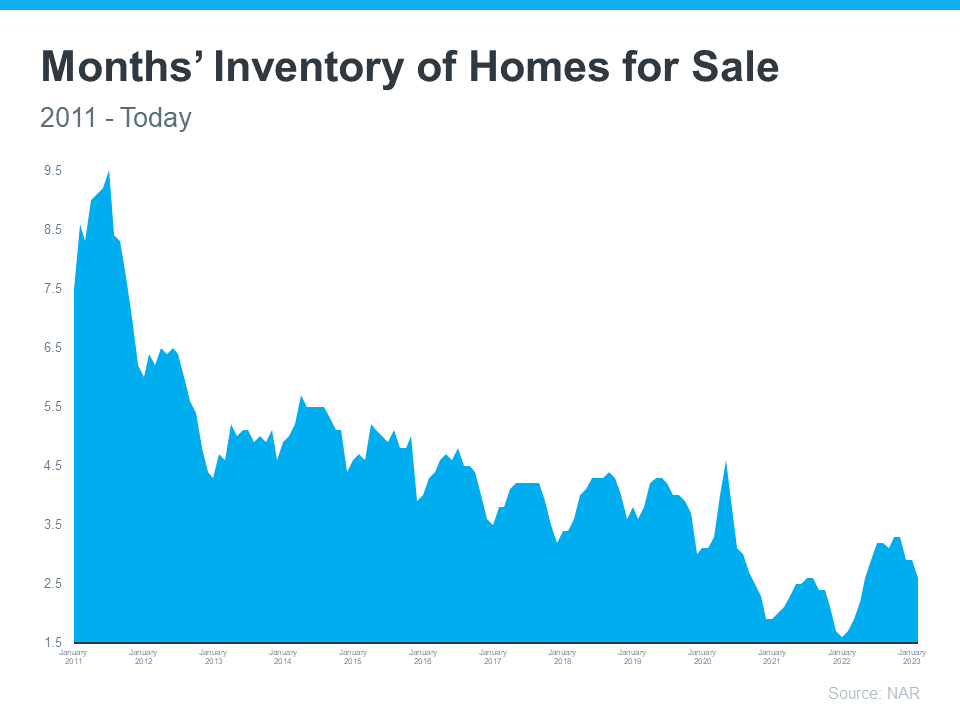

As you can see in the graph below, we’ve been at or near record-low inventory levels for a few years now.

Please note that in the bad old days when we were coming out of the Federal Government caused housing price collapse, we were at 9+ months of inventory. In fact, I recall that back in the real bad old days we got as high as 18 months in Delaware county.

That lack of available homes on the market is putting upward pressure on prices. Bankrate puts it like this:

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”

If more homes don’t come to the market, a lack of supply will keep prices from crashing, and, according to industry expert Rick Sharga, inventory isn’t likely to rise significantly this year:

“I believe that we’re likely to see low inventory continue to vex the housing market throughout 2023.”

Here is the recent history for Delaware county.

| DELAWARE COUNTY, MONTHS OF INVENTORY, SINGLE FAMILY, DETACHED | |||||||||||

| Month | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Jan | 11 | 9 | 9 | 6 | 7 | 7 | 5 | 3 | 3 | 4 | |

| Feb | 14 | 11 | 10 | 9 | 8 | 7 | 7 | 5 | 4 | 3 | |

| Mar | 11 | 10 | 10 | 7 | 6 | 7 | 5 | 4 | 3 | 2 | |

| Apr | 10 | 9 | 8 | 7 | 5 | 5 | 5 | 4 | 3 | ||

| May | 8 | 8 | 6 | 5 | 5 | 4 | 6 | 4 | 3 | ||

| Dec | 6 | 6 | 4 | 4 | 3 | 3 | 6 | 3 | 3 | ||

| Jul | 7 | 6 | 5 | 5 | 4 | 4 | 3 | 3 | 3 | ||

| Aug | 7 | 7 | 5 | 4 | 4 | 4 | 3 | 3 | 2 | ||

| Sep | 9 | 8 | 6 | 6 | 6 | 5 | 3 | 4 | 3 | ||

| Oct | 9 | 7 | 7 | 6 | 5 | 6 | 3 | 3 | 3 | ||

| Nov | 8 | 10 | 6 | 5 | 5 | 6 | 3 | 3 | 3 | ||

| Dec | 7 | 6 | 5 | 4 | 4 | 4 | 3 | 2 | 2 | ||

| Annual | 8.9 | 8.1 | 6.8 | 5.7 | 5.2 | 5.2 | 4.3 | 3.4 | 2.9 | 3.0 | |

Back in 2014, we had 14 months of inventory. It took until July of 2020 for inventory to reach and stay below 6 months, which is the dividing line between a buyer or balanced market and a sellers market. Sellers market being one in which we have more buyers than sellers (more demand than supply) which pushes prices up.

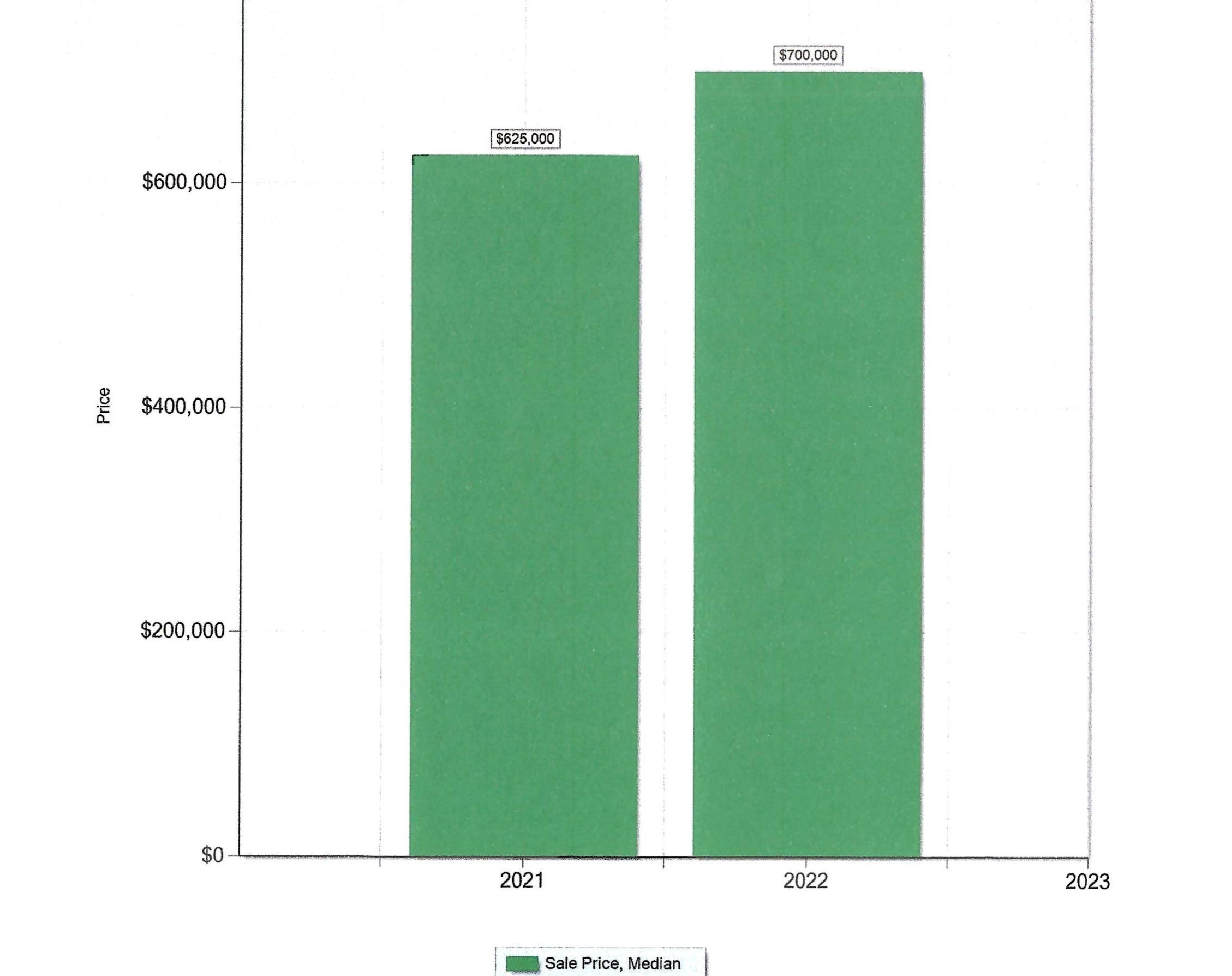

Even with the recent mortgage rate shocks, inventory levels are staying in the 3-5 month range. That is still strong seller market territory. Prices have responded like you would expect, as shown in the below chart.

| DELAWARE COUNTY, MEDIAN SALES PRICE, SINGLE FAMILY, DETACHED | |||||

| Primary Year | Sale Price, Median | Difference | % Diff | ||

| 2014 | $275,000 | ||||

| 2015 | $270,000 | ($5,000) | -1.8% | ||

| 2016 | $280,500 | $10,500 | 3.9% | ||

| 2017 | $297,750 | $17,250 | 6.1% | ||

| 2018 | $305,000 | $7,250 | 2.4% | ||

| 2019 | $320,000 | $15,000 | 4.9% | ||

| 2020 | $350,000 | $30,000 | 9.4% | ||

| 2021 | $390,000 | $40,000 | 11.4% | ||

| 2022 | $410,000 | $20,000 | 5.1% | ||

| Average % Increase Starting 2016 | 6.6% | ||||

Since we got under 6 months of inventory in 2020, price increases have only accelerated. 5 to 11% is too high to be long term sustainable but I see no signs of a significant price decline coming our way.

Sellers are under no pressure to move since they have plenty of equity right now. That equity acts as a cushion for homeowners, lowering the chances of distressed sales like foreclosures and short sales. And with many homeowners locked into low mortgage rates, that equity cushion isn’t going anywhere soon.

IMPLICATIONS FOR BUYERS AND SELLERS TODAY

- Is it a good time for first time buyer to get in the market? Yes. There will never be a better time to get that first house and begin to build your family’s net worth.

- Is it a good time for move up buyers to sell and get into that bigger better house they have been wanting. Again, yes. They will be able to sell for a price they can be happy with.

- With so few homes available for sale today, it’s important to work with a trusted real estate agent who understands your local area and can navigate the current market volatility. Finding a home you really want to move to can be a bit more difficult today and you need the advice of an experienced and capable agent to make sure that it works for you.

SUGGESTED NEXT STEPS FOR YOU TO MAKE SURE YOU HAVE THE INFORMATION YOU NEED TO MAKE THE RIGHT DECISION

- It’s also important to remember that every local market is different. That’s why it’s essential to lean on an expert for the latest information on the market in your area if you’re planning to make a move this spring.

- Do I think that now is a good time to sell and make that move up buy? Again, absolutely yes.

- To get a quick update of what is new in real estate, click here to check out our new videos.

- Interested in what recent clients think of my service? Click here to read what they say.

- Interested to know what your house is worth? Click here to get the most extensive and accurate estimate of home value that is available on the Internet. No cost or obligation of course.

- No doubt, the housing market is shifting, and it can be a confusing place right now. I suggest that we connect so that I can help you make confident and informed decisions about what’s happening. Minimize the fear or uncertainty that could change your plans. If you’re unsure about how to make sense of what’s going on in today’s housing market, text or call me at 484-574-4088 or go to my web site, (johnherreid.com) and lets set up a time to meet, either on line or in person. I have the software so that we can meet virtually and make the best use of your time.

- If you’re looking to make that move up buy this year, I believe now is a good time to do it. The best way to ensure you’re up to date on the latest market insights is to partner with a trusted real estate advisor. Let’s connect. I would like to interview for the job of becoming your trusted real estate advisor.

- One of the biggest benefits of owning a home, regardless of your income level, is that it provides financial stability and an avenue to build wealth. By selling your house and leveraging your equity, it can be easier to pay for your next home. Let’s connect to find out how much equity you have in your current home and how you can use it to fuel your next purchase.

- There are still clear opportunities for sellers this spring. If you’re wondering if it’s the right time to make a move, let’s connect today.